The rise of decentralized autonomous organizations (DAOs) is redefining the way crypto projects are launched, governed, and scaled. In a space where decentralization is a core philosophy, DAOs offer an alternative to traditional corporate structures — no CEOs, no boardrooms, no hierarchies.

In this article, we’ll explore how DAOs function as the organizational backbone of many Web3 initiatives and why they’re becoming the preferred model for funding and governance in the crypto ecosystem.

What Is a DAO?

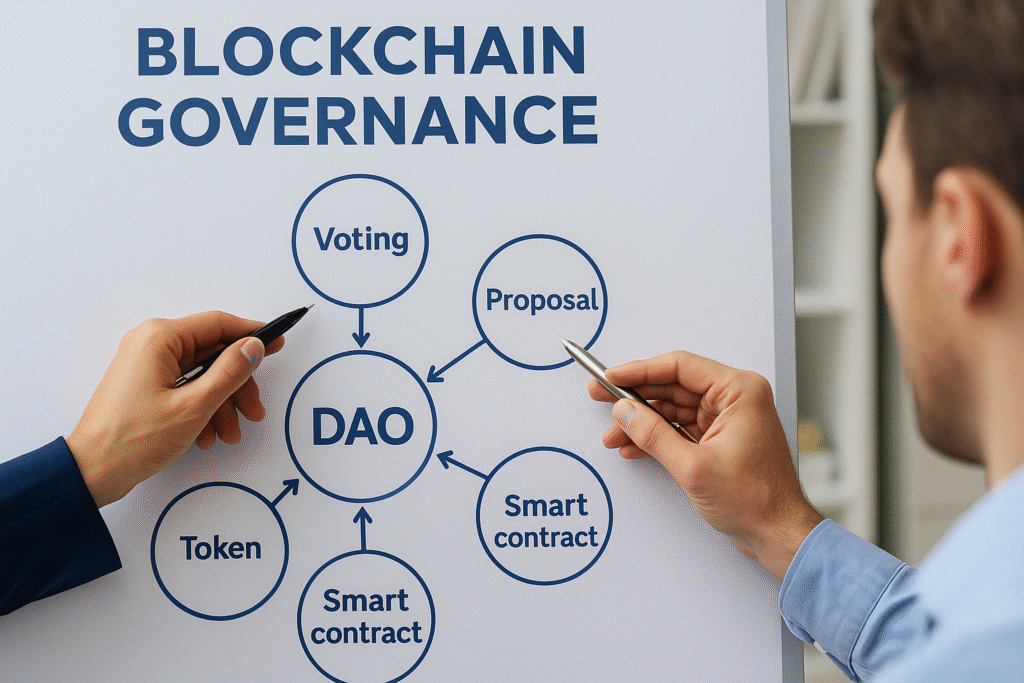

A DAO is a decentralized organization governed by code and community voting. Instead of executives making top-down decisions, DAOs allow token holders to propose and vote on key actions — from protocol changes to treasury spending. These organizations are typically built on smart contracts and operate transparently on blockchain networks like Ethereum.

Funding Without Venture Capital

One of the most disruptive aspects of DAOs is how they raise and manage capital. Traditional startups often rely on venture capital (VC), giving up equity and control in exchange for funding. Crypto projects using DAOs flip that model on its head.

Most DAO-led projects raise funds via token sales or initial DEX offerings (IDOs), allowing the community to invest early and collectively own a stake. These funds are pooled into the DAO treasury and allocated through governance proposals, removing the need for centralized financial decision-makers.

Gitcoin is an example of a DAO that funds open-source development by distributing grants through community-led voting, proving that democratic funding models can be highly effective.

Governance by the People

In a DAO, governance isn’t just a feature — it’s the core. Token holders have the right to vote on everything from roadmap priorities to hiring contributors. These votes are weighted by token ownership, though some DAOs are experimenting with quadratic voting and reputation systems to avoid plutocracy.

Governance frameworks vary widely:

- Snapshot: Used for off-chain voting.

- Aragon: Framework for building on-chain DAOs.

- Tally: Provides analytics and voting tools.

This democratization of decision-making brings users closer to the product and often results in more community-aligned decisions than a traditional startup.

Scaling Without Central Leadership

The lack of a CEO doesn’t mean lack of structure. DAOs often rely on working groups or subDAOs — autonomous pods focused on specific functions like development, marketing, or partnerships. These groups operate semi-independently but are still accountable to the larger DAO through funding proposals and reporting.

This modular structure allows DAOs to scale operations quickly without needing to expand a rigid hierarchy.

Challenges and Criticism

DAOs aren’t perfect. Some of the common challenges include:

- Voter apathy: Participation is often low.

- Security risks: Smart contract bugs can cripple a DAO.

- Coordination complexity: Achieving consensus across large communities is difficult.

Still, many in the space see these as solvable issues, and DAOs continue to evolve rapidly with better tooling and community onboarding strategies.

A New Paradigm for Organization

Crypto projects using DAOs are not just rejecting old models — they’re building something entirely new. By distributing power, aligning incentives, and embedding transparency into the core of operations, DAOs present a compelling alternative to startups run by charismatic founders.

As tooling improves and legal frameworks catch up, expect DAOs to play a growing role not just in crypto, but across digital-native industries looking to decentralize power.